In the world of textile manufacturing, where competition is fierce and margins are often razor-thin, Ambika Cotton Mills Ltd (ACML) shines as a true gem. This article delves deep into ACML, a company engaged in the manufacturing and selling of specialty cotton yarn, and explores the factors that make it an undervalued powerhouse in the textile industry.

The Company Overview

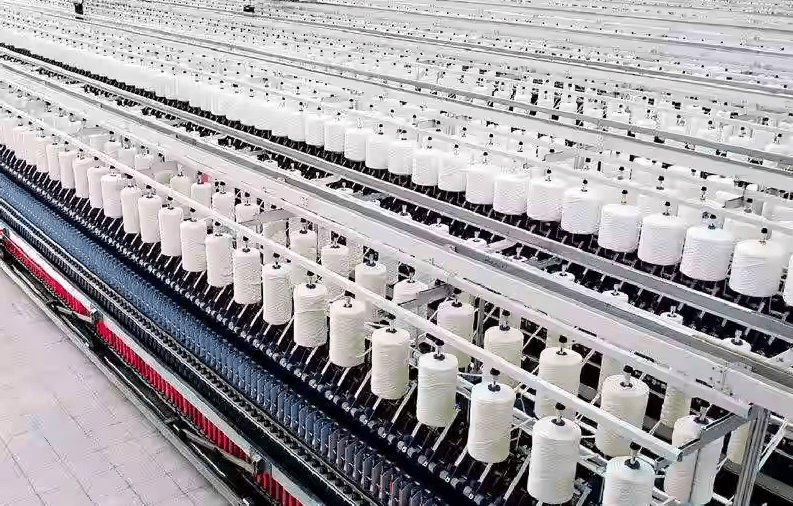

Ambika Cotton Mills Ltd specializes in the production of premium cotton yarn tailored to the needs of manufacturers of high-quality branded shirts and t-shirts. With a robust manufacturing infrastructure, a commitment to quality, and strategic international and domestic partnerships, ACML has become a prominent player in the textile sector.

Key Highlights

1. Marquee Customers: ACML boasts an impressive client base, with exports constituting a significant portion of its revenue. Overseas giants like Quannitex Enterprise Corporation, Pacific Textiles, and Winnitex Investment Company are among its main international clients. Domestically, it caters to industry leaders such as Arvind Mills, Raymond, Aashima Textiles, and Morarjee.

2. Manufacturing Capacity: The company operates with a total installed spindle capacity of 108,288, distributed across four units. Additionally, its knitting facility has the capability to convert 40,000 kilograms of yarn per day into fabrics, showcasing the company’s extensive production capabilities.

3. Geographical Segmentation: ACML’s reach extends globally, with a diverse geographical revenue distribution. In FY22, Asia accounted for 59% of the company’s revenue, followed by India at 34%, Africa at 3%, North America at 2%, and Europe at 2%.

4. Product Segmentation: ACML’s product portfolio is well-diversified. In FY22, cotton comprised 57% of the revenue, while yarn contributed 34%, and waste cotton made up the remaining 9%.

5. Premium Quality Yarn: What sets ACML apart is its commitment to manufacturing premium-quality compact and Eli Twist yarn. The company sources extra-long staple cotton from Egypt and the US, specifically Giza and Pima cotton, to ensure the highest quality. This premium yarn is used in the production of top-branded shirts and t-shirts.

6. Windmill Segment: ACML has displayed its commitment to sustainability by investing in windmills for 100% of its captive power requirements. These windmills, located in Tirunelveli, Dharapuram, and Theni, have an impressive installed capacity of 27.4 MW, reducing the company’s carbon footprint and enhancing its environmental credentials.

7. High Competition and Market Leadership: The textile industry is no stranger to competition, but ACML has managed to carve out a leadership position. Key competitors include Nahar Spinning Mills, Ruby Mills, and Amarjothi Spinning Mills. Despite this, ACML’s reputation and market presence remain robust.

8. Strong Liquidity: ACML’s financial stability is underscored by its healthy cash and cash equivalents, amounting to around Rs. 280 crore as of March 31, 2022. This liquidity provides the company with a strong foundation to weather economic challenges and seize growth opportunities.

Investment Potential

Ambika Cotton Mills Ltd’s strong market presence, commitment to quality, diversification, and sustainable practices make it an undervalued gem in the textile industry. With its global reach and premium products, ACML is well-poised to capitalize on the growing demand for high-quality textiles, both in domestic and international markets.

Investors looking for a company with a proven track record, solid financials, and a commitment to sustainability should consider ACML as a strong contender in their portfolio. As the textile industry continues to evolve, Ambika Cotton Mills Ltd stands as a shining example of excellence and resilience in a competitive landscape.

Challenges and Opportunities

While Ambika Cotton Mills Ltd presents a promising investment opportunity, it’s important to also consider the challenges and opportunities that lie ahead for the company.

Challenges:

1. Volatility in Raw Material Prices: ACML’s reliance on high-quality imported cotton exposes it to fluctuations in global cotton prices. Price spikes in cotton can squeeze profit margins, making effective risk management crucial.

2. Global Economic Uncertainty: The textile industry is sensitive to global economic conditions. Economic downturns can lead to reduced consumer spending on apparel, impacting ACML’s sales.

3. Environmental Regulations: While the company has invested in windmills for sustainable energy, it may face increasing environmental regulations that could necessitate further investments in green technologies.

Opportunities:

1. Growth in Premium Textile Demand: The global demand for premium textiles continues to rise as consumers seek higher-quality clothing. ACML’s specialization in premium yarn positions it well to benefit from this trend.

2. Export Growth: The company’s strong presence in international markets, including Asia, presents an opportunity for further expansion and increased market share, especially in emerging economies.

3. Innovation and Research: Continued investment in research and development to create new, innovative textile products could open up new markets and revenue streams.

4. Vertical Integration: Exploring opportunities for vertical integration, such as expanding into garment manufacturing, could allow ACML to capture more value along the supply chain.

Conclusion

Ambika Cotton Mills Ltd is not just a textile manufacturer; it’s a company that epitomizes excellence, quality, and resilience in a competitive industry. With a diversified product portfolio, a global presence, a commitment to sustainability, and a robust financial position, ACML stands as an undervalued gem with significant growth potential.

Investors seeking exposure to the textile sector should take a closer look at ACML. While the industry is fraught with challenges, this company has consistently demonstrated its ability to navigate them successfully. Its strong customer base, innovative product offerings, and strategic initiatives make it a compelling investment choice.

As the textile industry continues to evolve and adapt to changing consumer preferences and environmental concerns, Ambika Cotton Mills Ltd is well-prepared to not only weather the challenges but also thrive in an era of increasing demand for premium-quality textiles. ACML is indeed a hidden treasure waiting to be discovered by discerning investors seeking long-term growth and sustainability in their portfolios.